Monero's Atomic Units: How Privacy Money Scales from Piconeros to Meganeros

While Bitcoin stops at 8 decimal places, Monero goes to 12, a design choice that exposes who's actually thinking about money's future versus who's building digital gold for hodlers.

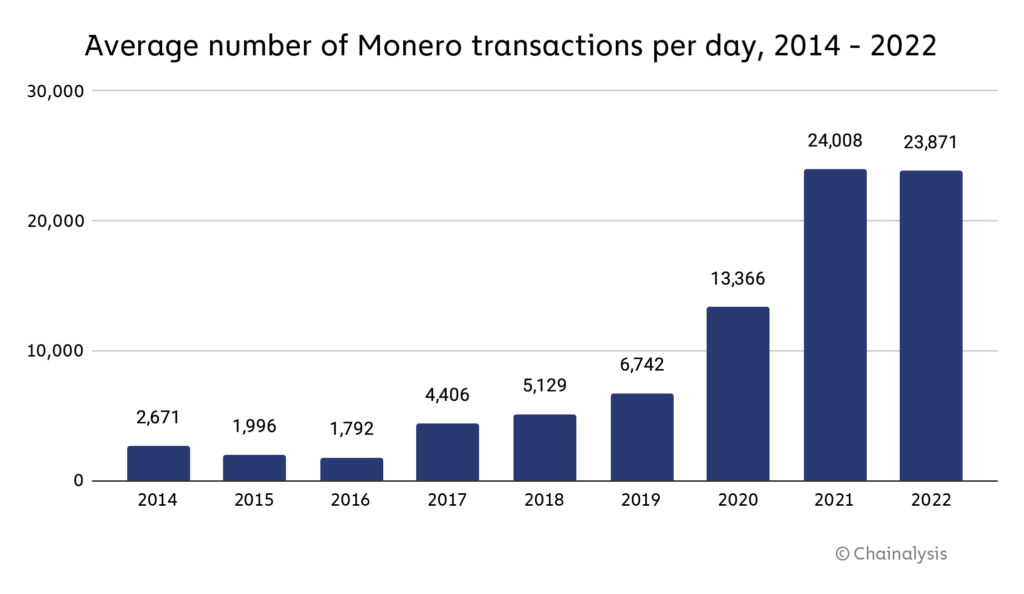

Monero (XMR) is the privacy coin that actually works, untraceable by default, fungible like cash should be, and structured with denominations that make Bitcoin's satoshi system look like a rounding error. The denomination framework landed in the Monero codebase on March 3, 2017, courtesy of developer Moneromooo. Before that, users dealt with unwieldy decimal strings. Now they have a systematic naming convention that scales from the microscopic piconero to the massive meganero.

The Piconero Foundation

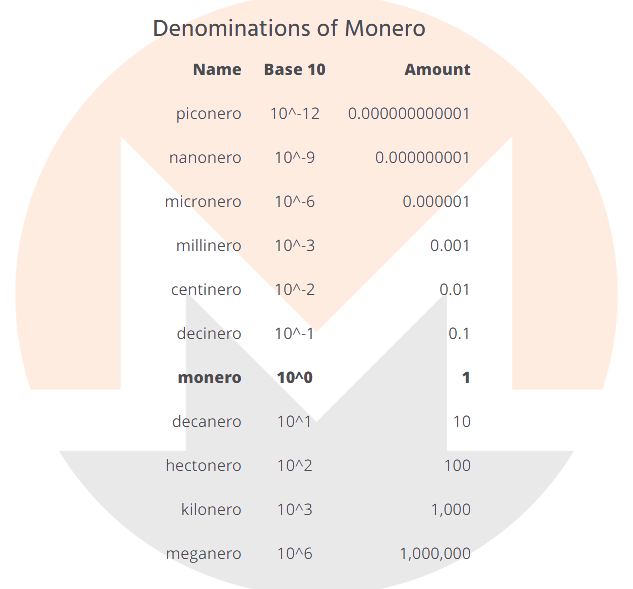

The atomic unit, the smallest indivisible piece of Monero, is the piconero at 0.000000000001 XMR (10^-12). Originally called a "tacoshi" after early contributor Tacotime, developers renamed it for consistency with the SI prefix system. This wasn't sentimentality; it was engineering pragmatism.

Bitcoin maxes out at 8 decimal places with the satoshi (0.00000001 BTC). Monero goes 10,000 times deeper. That's not accident or overkill, it's future-proofing against both micropayment architectures and potential value explosions. When transaction fees need to be calculated in fractions of fractions, or when a single XMR hits six figures, those extra decimal places become operational necessities, not theoretical exercises.

The Full Scale

The denomination ladder follows SI prefixes after dropping the "mo" from Monero:

1 XMR = 1,000,000,000,000 piconeros

Why Precision Matters

Monero's tail emission produces 0.3 XMR per minute forever after the main emission ends (around May 2022, already passed). Unlike Bitcoin's hard cap at 21 million, Monero maintains a predictable, minimal inflation rate of under 1% annually. This permanent block reward keeps miners incentivized without relying on transaction fees alone, a problem Bitcoin will face when its block rewards hit zero around 2140.

With infinite supply comes the need for infinite precision. Those 12 decimal places handle scenarios where XMR value could theoretically spike to millions per coin or crash to fractions of a cent. The denomination system scales both ways without breaking.

Consider micropayments. A content platform charging 100 nanoneros per article view works today. A decentralized API billing 10 piconeros per call works today. Bitcoin's 8 decimal places force these use cases into awkward workarounds or off-chain solutions that compromise the entire point of cryptocurrency, trustless, permissionless transactions.

Operational Security Implications

Using consistent denominations across wallets and exchanges reduces fingerprinting opportunities. When everyone expresses amounts in the same units, transaction analysis gets harder. A wallet showing "0.000000000001 XMR" stands out. A wallet showing "1 piconero" blends in.

The Monero GUI wallet and CLI tools accept denomination names directly. Instead of typing "0.001" and risking decimal errors, users type "1 millinero." This reduces user error, a critical OPSEC failure point when one misplaced zero sends funds to the wrong address or reveals spending patterns through unusual amounts.

Exchange interfaces that don't support denomination names force users into error-prone decimal entry. Avoid them. Most exchanges, including major ones like Kraken display Monero balances and orders in standard decimal XMR amounts; SI denomination names are generally not supported in exchange interfaces. Those that don't are either incompetent or intentionally creating friction for privacy coins, neither deserves your business.

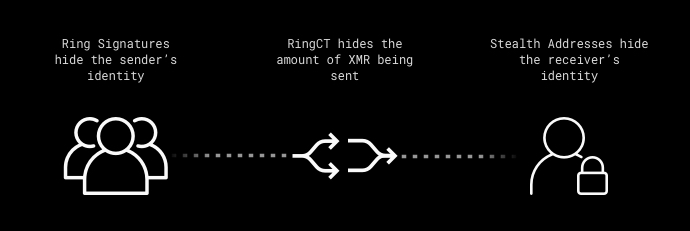

The RingCT Factor

Monero's RingCT (Ring Confidential Transactions) hide transaction amounts on the blockchain. But wallets still need to calculate fees, change, and outputs with perfect precision. The piconero enables this calculation without rounding errors that could leak information through fee analysis.

Every Monero transaction includes a fee measured in every Monero transaction includes a fee calculated in atomic units per kB (or weight unit), not in piconeros per byte. Wallets calculate these fees using integer math at the piconero level, then display them in human-readable denominations. This prevents floating-point errors from creating unique fee signatures that could compromise anonymity sets.

Practical Usage

Most users operate in the millinero to monero range. Current network fees run about 0.00001 XMR (10 microneros) for standard transactions. Exchanges typically require minimum withdrawals of 0.001 XMR (1 millinero) to cover fees and prevent dust attacks.

The meganero exists primarily as a theoretical upper bound. No single wallet has ever held a million XMR, the entire circulating supply is under 19 million. But having the denomination defined means systems can handle it if economic conditions shift dramatically. Zimbabwe didn't plan for trillion-dollar bills either, until they needed them.

Technical Implementation

The denomination The atomic unit (1e-12 XMR, or piconero) is protocol-level, but the SI denomination names are implemented in wallet software, not in the Monero daemon itself. Wallets parse user input, convert to piconeros for internal calculation, then display results in appropriate denominations. This happens transparently, users never see the conversion unless they examine raw transaction data.

Smart contract platforms trying to integrate Monero hit precision walls fast. Ethereum's 18 decimal places seem excessive until you're calculating privacy-preserving swaps between XMR and wrapped tokens. The piconero's 12 decimal places maintain precision through multiple conversion layers without accumulating rounding errors that break atomic swaps.

The Long Game

Monero's developers built denominations for scenarios they might never see. Machine-to-machine payments, autonomous agent transactions, hyperinflationary collapses, the system handles them all. Bitcoin's community argues about adding decimal places through soft forks. Monero solved it in 2017.

The denomination framework exposes a fundamental difference in philosophy. Bitcoin builds for digital gold holders measuring wealth in whole coins. Monero builds for actual users making actual transactions at any scale. One system assumes stability. The other assumes chaos. Given the state of global monetary policy, chaos seems the safer bet.

Every time a central bank prints another trillion, every time a payment processor blocks another transaction, every time a chain analysis firm claims another breakthrough, Monero's denomination system quietly handles the load. From piconeros to meganeros, the framework scales to meet reality, not force reality to meet the framework.

Privacy isn't just about hiding amounts. It's about having the precision to hide them properly, the flexibility to adapt to any economic environment, and the foresight to build systems that work whether XMR trades at $1 or $1,000,000. The denomination system delivers all three.