How Darknet Market Escrow Systems Actually Function (Technical Breakdown)

Darknet market escrow uses multisig cryptocurrency addresses and automated timers but remains vulnerable to administrator exit scams.

Darknet market escrow systems manage cryptocurrency transactions between buyers and vendors through automated smart contracts or manual administration processes that attempt to provide transaction security and dispute resolution in markets where traditional payment processors and legal systems are unavailable.

Multisignature Escrow Architecture and Key Management

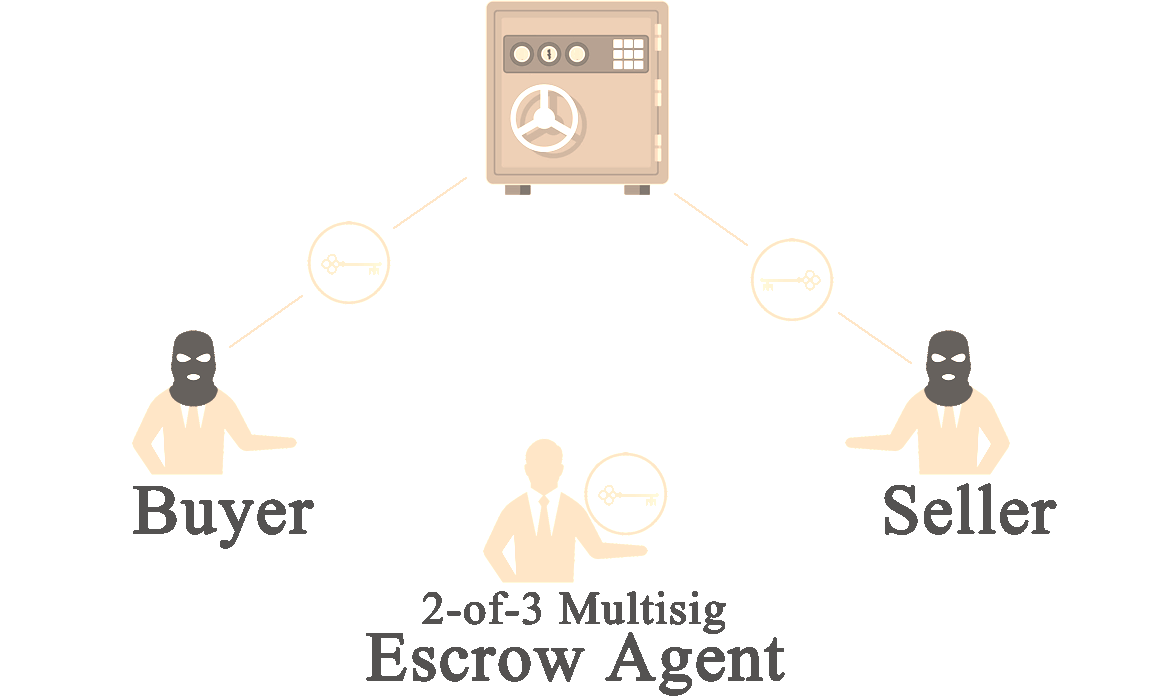

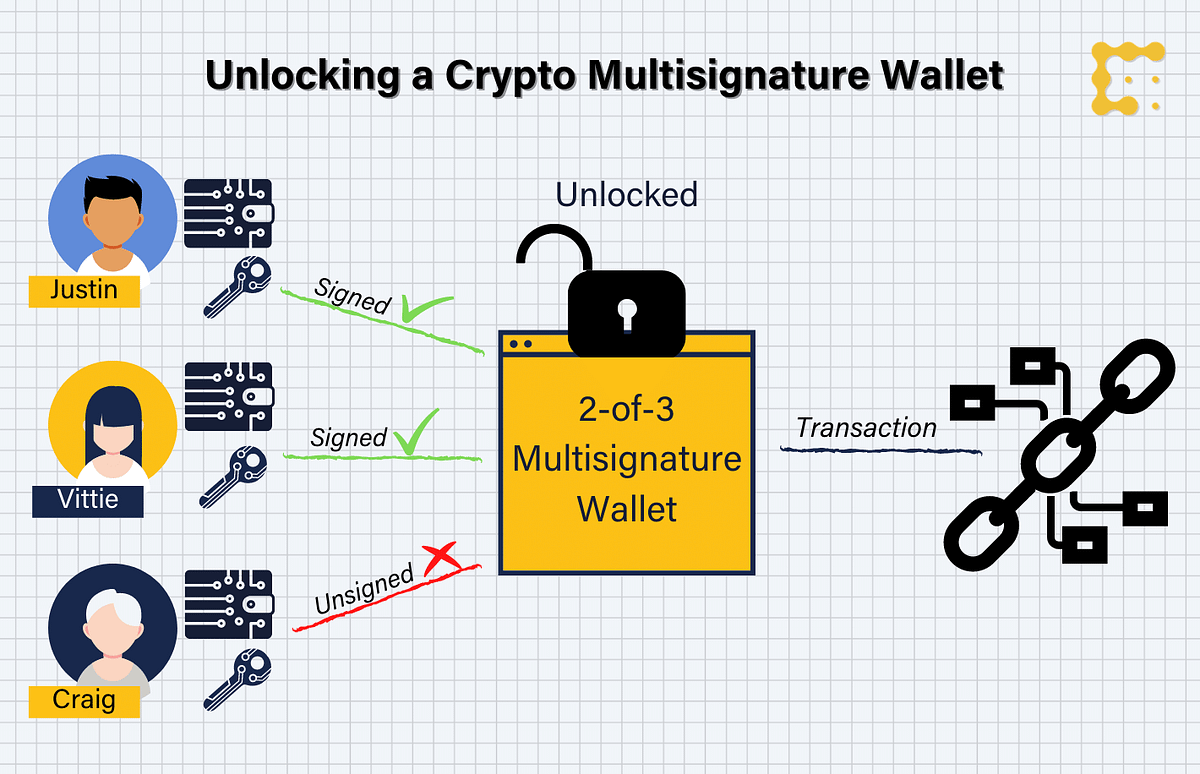

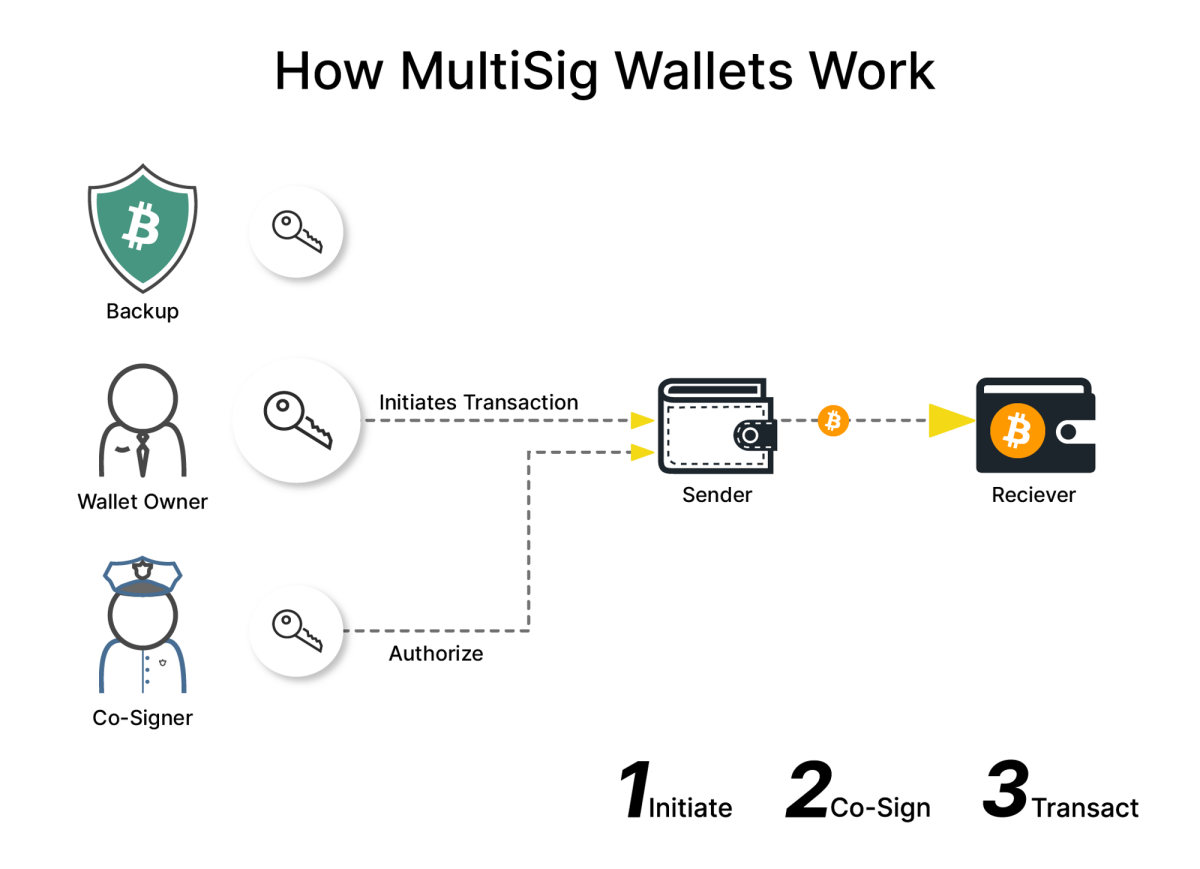

Modern darknet markets typically implement escrow through multisignature cryptocurrency addresses that require multiple cryptographic signatures to release funds, with the standard configuration requiring two of three signatures from the buyer, vendor, and market administrator to complete transactions. When a buyer places an order, their payment gets locked in a 2-of-3 multisig address where the buyer and vendor each control one key, while the market administration holds the third key for dispute resolution purposes.

This architecture prevents any single party from unilaterally access the funds while providing a mechanism for dispute resolution when buyers and vendors disagree about transaction completion. The key generation process typically involves the market platform creating the multisig address and providing the buyer and vendor with their respective private keys or signing mechanisms, though some markets allow users to provide their own keys for additional security.

Successful transactions occur when both buyer and vendor agree that the order has been completed satisfactorily, providing their signatures to release the funds from escrow to the vendor's address without requiring market administration involvement. Dispute resolution processes involve the market administrator using their key to side with either the buyer or vendor based on evidence provided by both parties, such as shipping confirmations, product photos, or communication logs that demonstrate whether the transaction was completed as agreed.

The multisig approach provides better security than centralized escrow systems where markets hold all funds directly, since even if the market's servers are compromised, attackers cannot steal funds without obtaining the private keys from users themselves. However, the system still requires trust in the market's dispute resolution process and creates risks if users lose their keys or if the market administrators disappear with the third key needed for dispute resolution.

Automated Release Mechanisms and Timer-Based Systems

Many darknet markets implement automated escrow release mechanisms that transfer funds to vendors automatically after predetermined time periods unless buyers explicitly dispute the transaction, reducing the need for manual intervention while providing protection against vendor fraud. Timer-based escrow systems typically hold funds for periods ranging from 7 to 21 days depending on the product category and shipping requirements, with domestic orders having shorter release times than international shipments that face longer delivery periods and customs delays.

The automated release mechanism assumes that buyers will receive their orders within the specified timeframe and will only dispute transactions if problems occur, allowing legitimate transactions to complete without requiring active buyer participation after the initial purchase.

Buyers can manually release funds early if they receive their orders quickly and are satisfied with the products, providing positive feedback for vendors while reclaiming their funds from escrow faster than the automatic timer would allow. Dispute initiation during the timer period pauses the automatic release and triggers manual review by market administrators who examine evidence from both parties before deciding whether to release funds to the vendor or refund the buyer.

Some markets implement graduated release systems where small portions of larger orders are released on shorter timers to provide vendors with partial payment while maintaining buyer protection for the remainder of the transaction value.

The timer-based approach reduces market administration workload since most transactions complete automatically without requiring human intervention, but creates risks for buyers who fail to monitor their orders and dispute problems before the automatic release deadline. Markets must balance timer lengths between providing sufficient time for delivery and dispute resolution while not holding funds in escrow unnecessarily long, since extended escrow periods create liquidity problems for vendors and increase the risk of market exit scams where administrators disappear with all escrowed funds.

Dispute Resolution Processes and Exit Scam Vulnerabilities

Darknet market dispute resolution relies on market administrators who review evidence from buyers and vendors to make binding decisions about escrowed funds, but this centralized process creates significant vulnerabilities to bias, corruption, and exit scam scenarios where administrators steal all held funds.

The dispute resolution process typically begins when buyers claim non-delivery, inferior product quality, or incorrect orders, providing evidence such as photos, shipping tracking information, or communication logs to support their claims against vendors.

Vendors can respond with their own evidence including shipping confirmations, product photos, or explanations for delays, creating a case file that market administrators review to determine the most likely outcome and assign funds accordingly. Market administrators face inherent conflicts of interest since they typically collect fees from both successful transactions and dispute resolutions, creating incentives to favor outcomes that encourage continued market usage rather than fair dispute resolution based purely on evidence.

The centralized nature of dispute resolution creates single points of failure where compromised or corrupt administrators can systematically favor certain vendors, steal funds from dispute cases, or manipulate the resolution process to benefit their own accounts or associated vendors.

Exit scam scenarios represent the ultimate vulnerability in centralized escrow systems, where market administrators disappear with all escrowed funds when the total value reaches levels that exceed the ongoing profit potential from legitimate market operations.

Historical analysis of darknet market closures shows that exit scams account for the majority of market closures, with administrators typically timing their exits during periods of high escrow volumes such as holiday seasons or after major vendor busts that increase user deposits.

The escrow system's security ultimately depends on market administrators maintaining their operations longer than the escrow holding periods, but the anonymous nature of darknet markets means users have no legal recourse when administrators choose to steal escrowed funds rather than continue legitimate operations.

This fundamental trust problem explains why many experienced darknet market users prefer direct deals with trusted vendors or limit their escrow usage to small amounts that minimize potential losses from market exit scams, accepting higher fraud risks from individual vendors to avoid the systematic risk of centralized escrow theft.