312 Dormant Silk Road Wallets Spring Back to Life

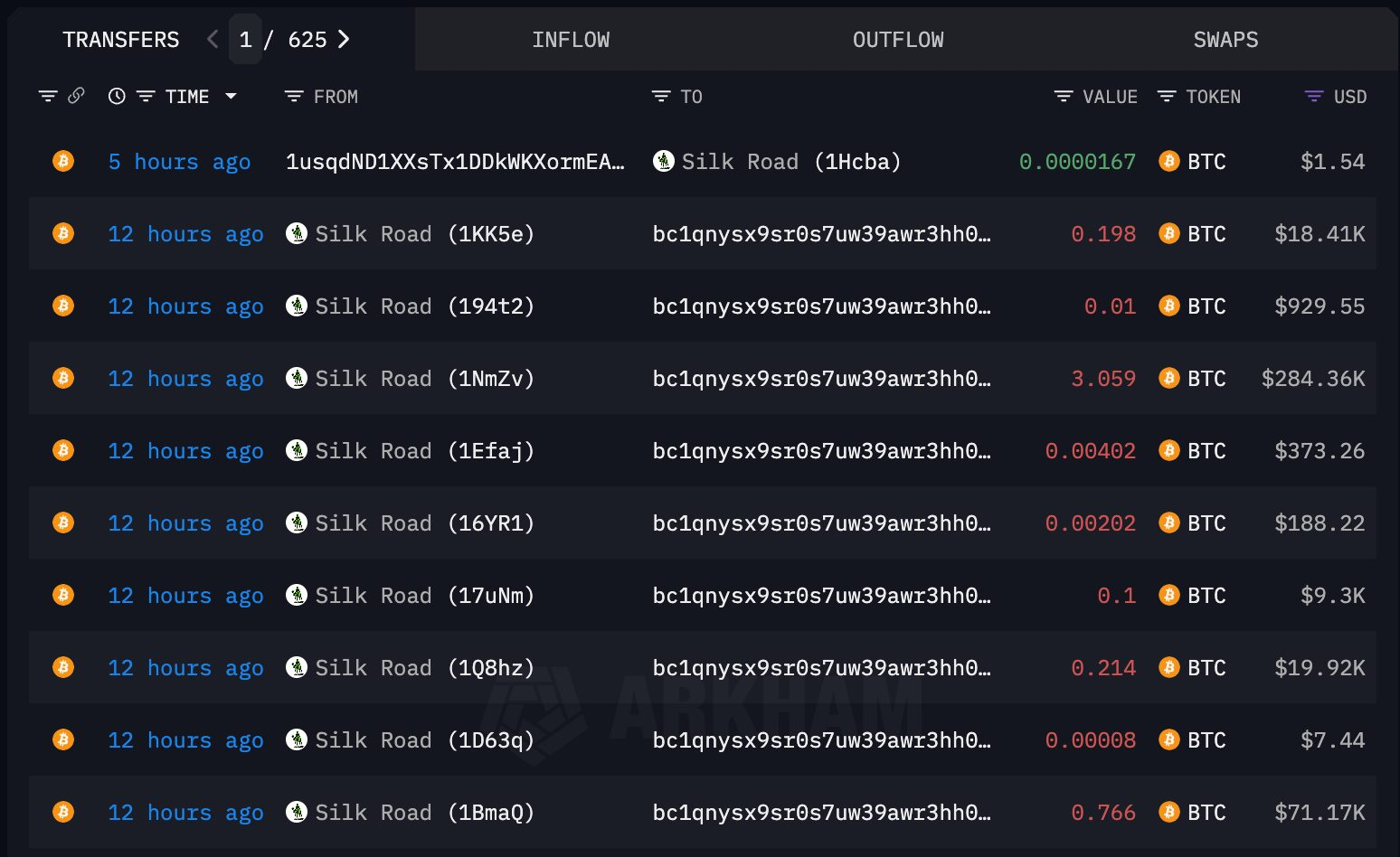

The 176 transactions over 12 hours suggest either someone methodically testing wallet access or an automated sweep consolidating legacy addresses into modern bech32 format.

(member test at the bottom)

Three hundred twelve cryptocurrency wallets linked to the defunct Silk Road darknet marketplace woke up on December 9, 2025, transferring $3.14 million in Bitcoin to a single unidentified address after more than a decade of dormancy. The coordinated movement, flagged by Arkham Intelligence, represents the most significant activity from these addresses in at least five years.

The 176 transactions flowed into a bech32 address starting with "bc1q" and ending in "ga54" over a 12-hour period. The wallets still hold approximately $41.3 million in Bitcoin after the transfers. Some of these addresses trace back to 2011-era mining activity, when Bitcoin mining still ran on consumer-grade hardware and Silk Road was establishing itself as the first large-scale venue to use cryptocurrency as a native payment system.

The identity of whoever controls these wallets remains unknown. Blockchain analytics providers tag these addresses as "Silk Road-related," but that label covers a wide range of possibilities: former marketplace operators, early users, law enforcement, or simply someone who ended up with access to the private keys through means that never made it into public record. The destination wallet "bc1q...ga54" remains unattributed to any known entity.

Coinbase Director Conor Grogan identified these holdings in January 2025, estimating approximately $47 million in Bitcoin across 430 addresses potentially linked to Ross Ulbricht, the marketplace's founder. Grogan resurfaced that analysis on December 9 after pseudonymous analyst "0xG00gly" from the Plasma Foundation flagged the movement. Grogan expressed doubt about whether Ulbricht himself could access these funds, noting that the wallet addresses were identified through court documents and that private key custody after 13 years of imprisonment seems unlikely.

The wallet activity coincides with ongoing uncertainty about what happens to the much larger stash of Silk Road Bitcoin held by the U.S. government. On December 30, 2024, Chief U.S. District Judge Richard Seeborg approved the Department of Justice's request to liquidate 69,370 Bitcoin confiscated from Silk Road, valued at approximately $6.5 billion. The ruling ended a four-year legal battle after the Supreme Court refused to hear an appeal challenging the seizure. Despite the approval, those coins remain in government custody and verifiably unsold on-chain.

On December 2, 2024, the DOJ moved nearly $2 billion worth of Silk Road Bitcoin to Coinbase via the U.S. Marshals Service's custody arrangement with Coinbase Prime. Trump has expressed interest in establishing a "Strategic Bitcoin Reserve" rather than liquidating government holdings, leaving the approved sale's future uncertain.

The 176 transactions unfolding over 12 hours suggests either manual consolidation by someone methodically working through wallet addresses or an automated sweep script. Converting legacy P2PKH addresses to modern bech32 format offers transaction fee savings and enhanced security, providing practical motivation beyond speculation about market timing. The controller consolidated $3 million while leaving $41 million untouched across hundreds of addresses—a pattern more consistent with testing wallet access than preparing for immediate liquidation.

Bitcoin held near $94,000 during the transfers, showing no price reaction. Past dormant wallet movements have sometimes preceded law enforcement actions or large exchange liquidations, but there's currently no evidence connecting these transfers to either scenario. Whoever holds those keys to a marketplace that shut down 12 years ago chose this moment to start moving, and blockchain forensics can trace every satoshi except the one piece of information that actually matters: who controls the destination wallet and why they're consolidating now.